Limited Capacity To Stack Ceramic Dielectric Extend MLCC Shortages

- Posted by doEEEt Media Group

- On June 7, 2020

- 0

Limited Capacity To Stack Ceramic Dielectric Will Extend MLCC Shortages To 2020 and beyond.

- Limited capacity expansion in the MLCC industry, specifically the ability to stack ceramic layers (limited capex in three-dimensional stacking capacity for barium titanate dielectric composition and nickel electrode paste) will extend shortages of MLCC to 2020 and beyond.

- As a result of expanding margins in ceramics- MLCC Manufacturers are NOT supporting low margin ceramic businesses, especially those that have exposure to precious metals such as ruthenium and palladium.

- MLCC are the Workhorse of the Electronic Components Industry. They are relied upon and used across multiple industries. In fact, because of the scientific principal governing electrical and electronic circuits, the requirement for capacitance and resistance is mandatory. The most cost-effective solution had been and will continue to be for the next ten years the stacking of ceramic, but anywhere that other dielectrics can be employed will now grow as manufacturers have no choice but to distance themselves from such a tremendous reliance on barium titanate-based ceramic dielectric. This will impact demand and capacity for other dielectrics, and force the development of next-generation ultra-small component technologies that are based upon new processes (but familiar materials).

- The near-term process will be that customers will lose support in key segments; especially in consumer AV and home appliance where the added loss of key MLCC vendors in Y5V dielectric has placed added pressure on prices.

- Any manufacturer with ceramic production capability will be targeted and rapidly approved as a vendor of capacitors in markets, especially automotive, where they have not supplied before. Competition for MLCC will become more pronounced because the high-tech supply chain only reacts when it is under intense pressure, and then it tends to overreact in the opposite direction.

Strategies for Managing Short Supply Scenarios

The traditional methods for addressing a parts shortage is to assume all manufacturers are the same and simply move down the supply base from tier one, to tier two, to tier three vendor levels and then target specific products that might be critical but unusual (high voltage, high temperature, NPO type) that may be sourced to smaller vendors in China, Singapore, Thailand, Malaysia, Slovenia, Hungary, Czech Republic, Japan, Australia, etc. The problem with this scenario is that everyone is already on this course of action as a viable strategy and capacity have already filled up in most of those areas do to the similar processes that buyers use to address problems like shortages of components. Some finance companies and manufacturers are already researching the raw material supply China’s in barium titanate, nickel, equipment, testing, to see who is best positioned to handle the coming shortages and who will benefit in FY 2020 as the market rushes to find alternative methods to produce MLCC and the PCB. From a Paumanok view, the very limited supply base and technology hurdles required to compete in high capacitance MLCC make outside challengers a very limited threat because the supply chain for advanced engineered materials is even more limited and from the base in Japan supplies all the companies with captive BT and Ni powders.

Alternative methods outside the mainstream are already upon us in the form of thin and thick film integrated passive devices and integral passive substrates. This is the next generation of capacitance, resistance and inductance generation for volumetric efficiency and the next big area for passive component investment. The TDK investment in thin film barium strontium titanate production speaks volumes for the future, and Murata’s purchase of IPDIA points the way toward the next requirements for handset module manufacturers and wearables to generate power, connect and provide the capacitance and energy density needed to create advanced functionality and complete autonomous black box systems, be it a module, handset or automobile.

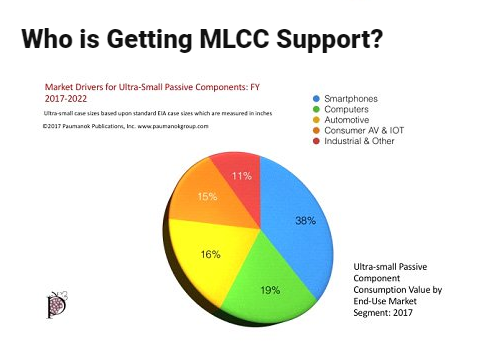

The Ultra-Small Case Size Content

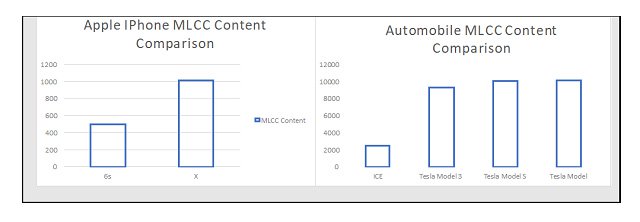

The following chart illustrates the adjustments to MLCC quantities by end-product market. So two key soft spots are in the increased capacitance requirements in handset and automobiles, which takes a significant jump upward as well move from the Apple 6s to the Apple X; and as we move from internal combustion engines to Electric Vehicles.

MLCC Content in Apple Phone and Tesla EV Migration

Source: KEMET Financial Presentation Feb 2018- ICE- Internal Combustion Engine- This trend is constantly upward and in motion. The content shifts upward inside handsets and cars will consume all the world’s stacking capacity. Real shortages will materialize as soon as the handset business begins to gobble up parts to satisfy internal shifts in black box requirements for capacitance.

What Paumanok is also pointing out in the above table is that there are similarities and overlap in the MLCC chain and the demand is focused on the high layer count, high capacitance MLCC in the X5R and X7R performance dielectric. These are stacked up to 1,000 layers to achieve the desired capacitance. Therefore, the capacity to stack ceramic is overwhelmed and the technology is so advanced in terms of manipulation of ceramic and metal nano-technology that the opportunity for the market to be overrun with the competition is highly unlikely. MLCC manufacturers are all in an excellent position to continue to benefit from this shortage of stacking capacity. It will also pull away the focus of these key ceramic capacitor manufacturers from any business segment or product line that is not as attractive as high capacitance MLCC, therefore, expect shortages in high voltage and high temperature capacitors and resistors that have constructions that expose them to the price of PGM metals (ruthenium and palladium).

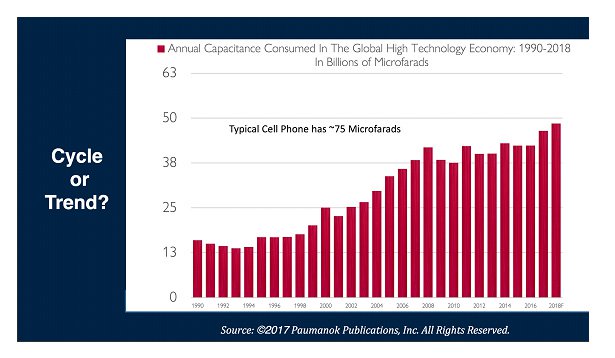

Capacitance Requirements per Person:

The following chart compares the volume of capacitors sold by capacitance value in microfarads to the global population to reveal that humans are requiring more capacitance each year. This can also be said of bandwidth and energy density and these three trends are important signposts for investment.

Capacitance Requirement Trends Per Person

Source: Paumanok Publications, Inc.

Where The Bottleneck In The MLCC Supply Chain Exists and What Customers are Doing to Overcome It

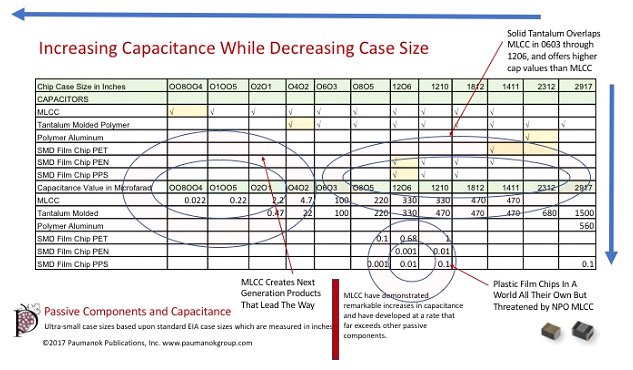

The following chart illustrates the nature of the bottleneck in the MLCC supply chain and shows first how MLCC far exceed other dielectrics capabilities in creating capacitance in very small case size. Tantalum comes very close and is therefore also benefiting from the short supply scenario in high cap MLCC.

Alternatively, what some customers of MLCC are doing, especially in consumer AV, lighting, power supply, industrial and some traditional ICE automotive lines are reviewing the following table to determine if they can create alternative reference designs that limit the exposure to high cap ceramics, especially in areas where competition is limited.

The drivers behind the market are in handsets and portable computing. Automotive is only getting attention for new applications in electric vehicles. Traditional ICE manufacturers are losing support for UTH applications where profitability is difficult due to demanding requirements, exposure to precious metals. Complex solutions in TV sets, home automation, home appliance and especially for home monitor (i.e. Amazon Echo Dot- large brands new to high-tech black box markets; consuming huge amounts of MLCC; video cards for crypto-currency trading consuming power hungry application specific integrated circuits and related support MLCC) must pay large premiums for parts against handsets. Paumanok research shows year on year loss in passive component revenues from consumer AV segment worldwide due to massive improvements in handsets- subsequent decisions for component manufacturers to stop supporting consumer AV and related products created competition for MLCC. One vendor noted that the Bill of Materials for Black Box products was so massive and passive components so small (3.8%) that adjusting to compete for parts in short supply was not a major issue, as cost savings could be found in other areas.

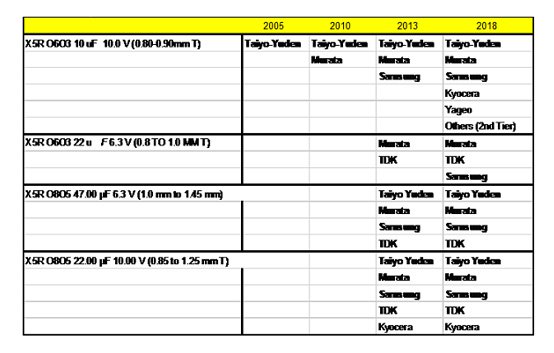

Technology Hurdles Keep Competition Minimal, Customers Have Limited Transparency, Think All MLCC Are The Same

The following chart reveals that the technology to produce MLCC at high capacitance requires specific expertise because the product must not only have high capacitance for its small case size but also must adhere to voltage requirements and thickness requirements. It seems that the added equation of thickness truly limited the competitive landscape and caused some vendors to fall behind on the technology roadmap.

Limited Competition In X5R O6O3 and O8O5 MLCC

Source: Paumanok Publications, Inc.

Why The Shortage of MLCC May Last 5 Years:

Paumanok research illustrates how long it takes for vendors to achieve breakthroughs in capacitance value per cubic centimeter of ceramic MLCC. Roadmaps are difficult to achieve profits and long term exposure to ceramic and metal stacking technology is required to achieve profitable results. The high cap BME MLCC process is very strict and yield ratios are constantly in flux. This limits vendors in the business achieving next levels in capacitance + Case size equations, and also creates barriers to entry for other vendors in ceramic capacitors, and makes it almost unattainable for manufacturers of alternative dielectrics or unrelated electronic components.

This technical barrier and the limited capacity of alternative dielectrics to compete with the massive economies of scale of MLCC lead us to believe that capex may be limited and the shortage of MLCC may last up to 5 years. This added attraction of premium prices will draw manufacturers away from unprofitable segments of the business leaving customers looking for alternative solutions.

Applications of Nano-Technology Into MLCC Technology Advancement Can Take Up To 90 Months {BOX- JENKINS ANALYSIS}

Source: Paumanok Publications, Inc. The above table shows how difficult it is for vendors to master the art of depositing ceramic and metal and stacking layers effectively in such small case sizes. The supply chain to do it is narrow, and the number of vendors who can accomplish it remains limited. This gap in technology could create an extended shortage of MLCC for an extended period of time.

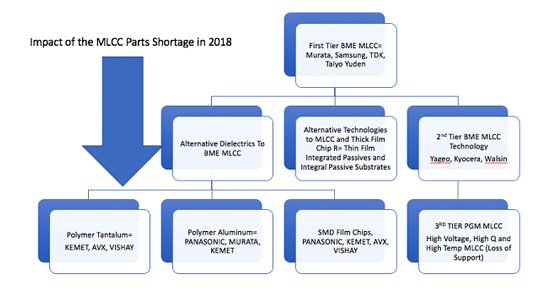

How MLCC Shortages Might Impact Demand For Other Dielectrics: FY 2019-2023

Shortages of MLCC are expected to drive demand to second-tier vendors and the allure of profits in high cap BME MLCC will ensure that tooling and capex will focus on the most profitable segments. This will also impact specialty ceramic consumption as vendors do not support unprofitable businesses segments. Customers will look to balance out their printed circuit boards with alternative reference designs that may include such alternative dielectrics as polymer tantalum, polymer aluminum and SMD film chip capacitors where the thickness, case size, and voltage allows. It will also mark the beginning of a concerted effort to alleviate demand for MLCC through the focused effort to develop and expand the capacity to produce integrated passive devices and integral passive substrates, especially for the handset module and smartwatch businesses.

Source: Paumanok Publications, Inc.

source: TTI Market Eye

Denis Zogbi from Paumanok shares his view on MLCC shortage in its recent article for TTI Market Eye.

- Space-Grade components available for immediate delivery - April 10, 2025

- Exclusive stock on doEEEt: How to access and request - April 10, 2025

- Managing EEE components for LEO and lower cost space missions - December 17, 2024

0 comments on Limited Capacity To Stack Ceramic Dielectric Extend MLCC Shortages