Customs clearance and tax-related duties for EEE parts

- Posted by Federico Fernández Esquivel

- On December 11, 2020

- 0

What is Customs Clearance?

Any company that exports or imports goods with other countries not belonging to the EU Customs Union must carry out the Customs clearance.

The Customs Clearance is the set of procedures carried out to control, monitor, and approve the entry or exit of goods in a particular territory during any international trade operation.

Consequently, it can be said that Import Customs Clearance is a delicate process because the Customs office of entry will carry out a series of documentary and physical controls to check that the goods comply with all the requirements in terms of customs duties and taxes, as well as other commercials, health and safety requirements.

The customs clearance is a crucial part of the EEE procurement process since countries worldwide are taking part in this activity.

It is therefore of great importance to know how it works in order to release the goods quickly and avoid having to pay any unnecessary taxes.

GET IN TOUCH TODAY!

Do you have questions? Contact us!

How is customs clearance done?

The person in charge of performing the customs clearance is the customs agent, who represents the importer or the exporter at the customs within the international transport process.

Among other actions, the customs agent is responsible for notifying the client of any information announced by customs, as well as for paying taxes and duties on his or her behalf, among other tasks.

This process is based on the declaration of certain information related to the import before the corresponding customs authority, such as the data of the goods and the persons or organizations that are in charge of sending or receiving it.

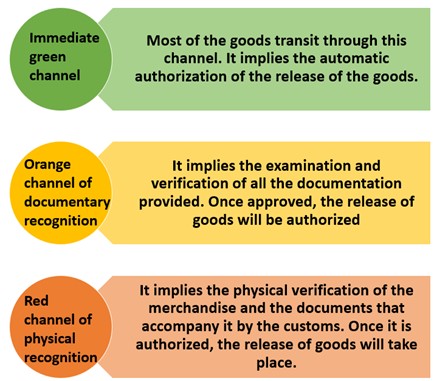

The goods are declared by the customs representative in a computerized manner, and the customs office assigns a channel that evaluates the risks and the need to inspect these products, based on, among other factors, the identity of the exporter, the type of goods and so on.

The existing channels in customs clearance are:

Dual-use export authorisations

On some occasions, customs could request a statement to ensure that goods initially classified as dual-use will not be used for military purposes.

Do I have to pay taxes?

The customs authorities will be checking if any taxes or duties apply to your goods. It will depend on the value, the law from the importing country and type of good.

Most EEE-parts go through customs tax-free. Only some components that belong to the following families eventually have taxes associated: transformers, wires, connectors, filters, relays, switches, fuses and coils.

Customs officers will request payment of taxes and duties if they have not been paid. At this point is where the Incoterm selected to have its appearance.

For instance, if shipping conditions were as DDP, this means that the seller already handled payment.

Once outstanding taxes and duties have been paid, the shipment is released. So, that would be it! goods continue their journey to the destination!

- Customs clearance and tax-related duties for EEE parts - December 11, 2020

0 comments on Customs clearance and tax-related duties for EEE parts